NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL.

Meyer Burger Technology AG (SIX: MBTN, 'Meyer Burger', the 'Company' or the ‘Guarantor’) today announces the launch of approx. EUR 230 million green senior unsecured guaranteed convertible bonds (the 'Bonds').

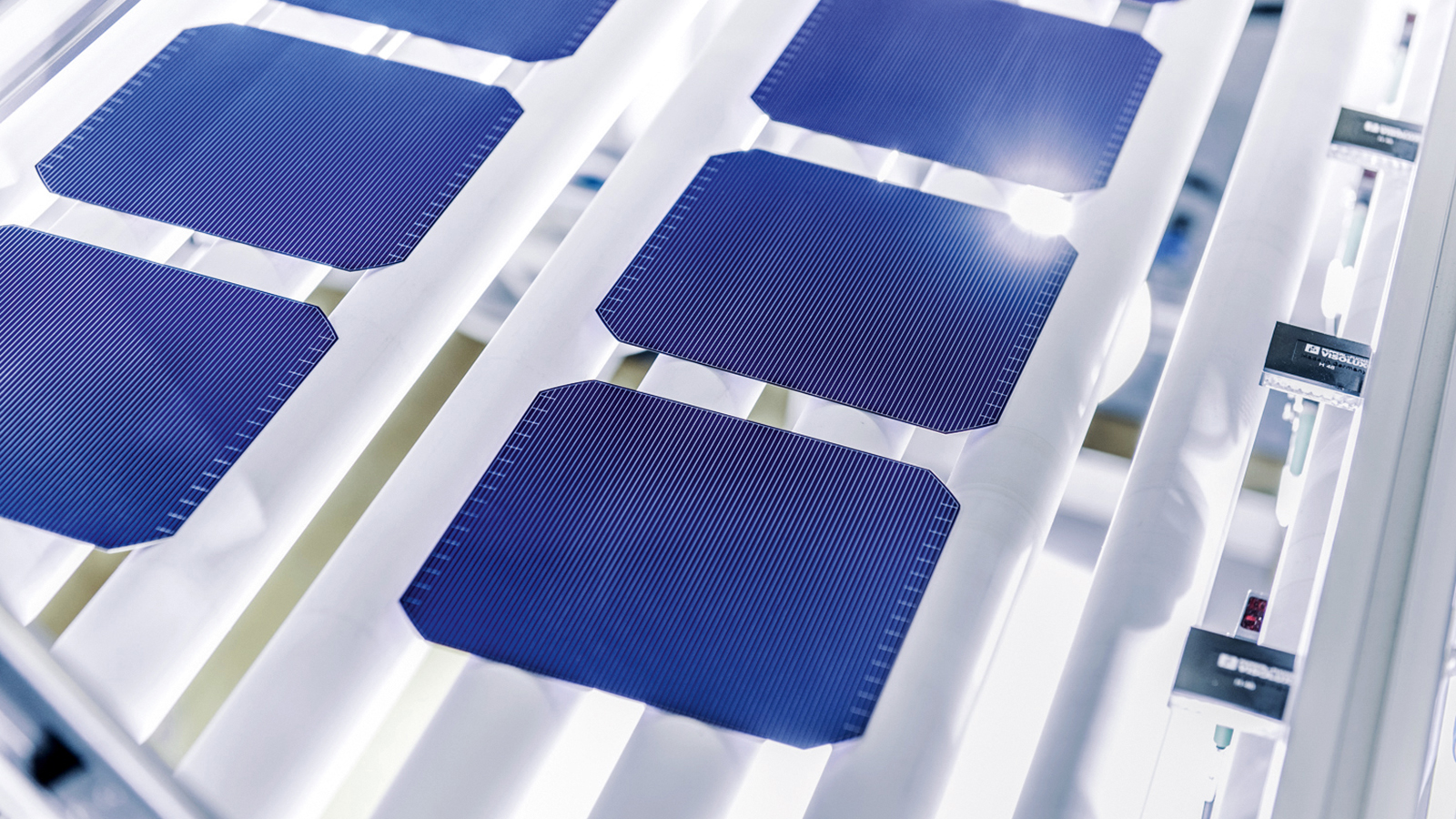

Meyer Burger is ready to accelerate the next growth phase, including the ramp-up of the production site in Goodyear, Arizona, USA. “The net proceeds from the bond issue shall be used to finance the material and equipment sourcing, and ramp-up of module and cell production in response to the expected acceleration of solar energy expansion, now that Europe, like the USA, is also looking to provide public incentives”, says CEO Gunter Erfurt.

Meyer Burger intends to place Bonds with an aggregate principal amount of approx. EUR 230 million that will be issued by the Issuer and guaranteed by the Company.

The Bonds will be issued with a denomination of EUR 100,000 per Bond at 100% of their principal amount and are expected to carry a coupon between 3.500% and 4.000% per annum, payable semi-annually in arrears. Unless previously converted or repurchased and cancelled, the Bonds will be redeemed at 100% of their principal amount on May 17, 2029.

The Bonds will be convertible into newly issued or existing registered shares of the Guarantor of currently CHF 0.05 nominal value each (the "Shares"), at an initial conversion price expected to be set at a premium between 25% and 30% over the volume weighted average price of the Shares on the SIX Swiss Exchange Ltd between launch and pricing of the offering (translated into EUR using the prevailing EUR:CHF foreign exchange rate). Shares issued or delivered upon conversion of the Bonds will have the same rights and entitlements as, and rank pari passu in all respects with, all other Shares of the Guarantor.

The net proceeds from the issue of the Bonds shall be used to finance and/or refinance investments in Eligible Green Projects as defined by the Guarantor’s Green Financing Framework dated June 2021 including material and equipment sourcing and the ramp-up of module and cell production in response to the expected acceleration of solar energy expansion.

Meyer Burger will be entitled to redeem the Bonds at their principal amount plus accrued interest in accordance with the terms and conditions of the Bonds at any time (i) on or after June 7, 2027, if the price of a Share is equal to or exceeds 130% of the then prevailing conversion price over a certain period or (ii) if less than 15% of the aggregate principal amount of the Bonds remain outstanding.

The offering of the Bonds will be conducted as a private placement to professional clients in Switzerland and to investors outside the US (in reliance on Regulation S under the US Securities Act of 1933, as amended), and in compliance with the laws and regulations applicable in every country where the offering takes place.

The Bonds are expected to price later today. The settlement and payment date of the Bonds is expected to be on or around May 17, 2023. The Bonds will not be listed or admitted to trading on the SIX Swiss Exchange or any other trading venue and no application has been made to list or admit the bonds to trading. Application for the listing and trading of the Bonds may be made at a later stage.

The Issuer and Meyer Burger have agreed to a 90-day lock-up period after the issuance of the Bonds, subject to customary exceptions and waiver by the syndicate banks.

Media contacts

Meyer Burger Technology AG

Anne Schneider

Head Corporate Communications

M. +49 174 349 17 90

anne.schneider@meyerburger.com

Dynamics Group AG

Andreas Durisch

Senior Counselor

T. +41 43 268 27 47

M. +41 79 358 87 32

adu@dynamicsgroup.ch

Disclaimer

This document is not an offer to sell or a solicitation of offers to purchase or subscribe for any securities. This document is not a prospectus within the meaning of the Swiss Financial Services Act and not a prospectus under any other applicable laws. Copies of this document may not be sent to jurisdictions, or distributed in or sent from jurisdictions, in which this is barred or prohibited by law. The information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, in any jurisdiction in which such offer or solicitation would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any jurisdiction.

This document is not for publication or distribution in the United States of America (including its territories and possessions, any State of the United States and the District of Columbia), Canada, Japan or Australia or any other jurisdiction into which the same would be unlawful. This document does not constitute an offer or invitation to subscribe for or purchase any securities in such jurisdictions or in any other jurisdiction into which the same would be unlawful. In particular, the document and the information contained herein should not be distributed or otherwise transmitted into the United States of America or to publications with a general circulation in the United States of America. The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the “Securities Act”), or the laws of any state, and may not be offered or sold in the United States of America absent registration under or an exemption from registration under the Securities Act. There will be no public offering of the securities in the United States of America.

The information contained herein does not constitute an offer of securities to the public in the United Kingdom. No prospectus offering securities to the public will be published in the United Kingdom. This document is only being distributed to and is only directed at persons who (i) are outside the United Kingdom or (ii) are “qualified investors” within the meaning of article 2 of the Prospectus Regulation (Regulation (EU) 2017/1129) as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 who are also (A) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended from time to time (the “FSMA Order”) or (B) high net worth entities falling within Article 49(2)(a) to (d) of the FSMA Order (all such persons being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

In any member state of the European Economic Area, this document is only addressed to “qualified investors” in such member state within the meaning of Regulation (EU) 2017/1129, and no person that is not a qualified investor may act or rely on this document or any of its contents.

This publication may contain specific forward-looking statements, e.g. statements including terms like “believe”, “assume”, “expect”, “forecast”, “project”, “may”, “could”, “might”, “will” or similar expressions. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may result in a substantial divergence between the actual results, financial situation, development or performance of Meyer Burger Technology AG and those explicitly or implicitly presumed in these statements. Against the background of these uncertainties, readers should not rely on forward-looking statements. Meyer Burger Technology AG, MBT Systems GmbH and the banking syndicate assume no responsibility to update forward-looking statements or to adapt them to future events or developments.

Except as required by applicable law, none of Meyer Burger Technology AG, MBT Systems GmbH or the banking syndicate has any intention or obligation to update, keep updated or revise this publication or any parts thereof following the date hereof.

The banking syndicate is acting exclusively for Meyer Burger Technology AG and MBT Systems GmbH and no-one else in connection with the offering. They will not regard any other person as their respective clients in relation to the offering and will not be responsible to anyone other than Meyer Burger Technology AG and MBT Systems GmbH for providing the protections afforded to their respective clients, nor for providing advice in relation to the offering, the contents of this announcement or any transaction, arrangement or other matter referred to herein.

In connection with the offering of the securities, the members of the banking syndicate and any of their affiliates may take up a portion of the securities in the offering as a principal position and in that capacity may retain, purchase, sell, offer to sell for their own accounts such securities and other securities of the Meyer Burger Technology AG and MBT Systems GmbH or related investments in connection with the offering or otherwise. The members of the banking syndicate and any of their affiliates may enter into financing arrangements (including swaps, warrants or contracts for differences) with investors in connection with which the members of the banking syndicate and any of their affiliates may from time to time acquire, hold or dispose of securities. The banking syndicate does not intend to disclose the extent of any such investment or transactions otherwise than in accordance with any legal or regulatory obligations to do so.

None of the members of the banking syndicate or any of their respective directors, officers, employees, advisers or agents accepts any responsibility or liability whatsoever for or makes any representation or warranty, express or implied, as to the truth, accuracy or completeness of the information in this announcement (or whether any information has been omitted from the announcement) or any other information relating to Meyer Burger Technology AG or MBT Systems GmbH, their subsidiaries or associated companies, whether written, oral or in a visual or electronic form, and howsoever transmitted or made available or for any loss howsoever arising from any use of this announcement or its contents or otherwise arising in connection therewith.