NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL

Meyer Burger's German subsidiary MBT Systems GmbH (the 'Issuer') successfully placed green senior unsecured guaranteed convertible bonds due 2029 in the amount of EUR 216.3 million (the 'Bonds')

Meyer Burger Technology AG (SIX: MBTN, 'Meyer Burger' or the 'Company') today has successfully raised EUR 216.3 million from private placement of green senior unsecured guaranteed convertible bonds, with a coupon of 3.75% per annum.Meyer Burger placed Bonds with an aggregate principal amount of EUR 216.3 million that will be issued by the Issuer and guaranteed by the Company. The underlying shares are newly issued or existing registered shares of Meyer Burger of currently CHF 0.05 nominal value each (the "Shares").

Shares issued or delivered upon conversion of the Bonds will have the same rights and entitlements as, and rank pari passu in all respects with, all other Shares of the Guarantor.

The Reference Share Price is EUR 0.5453, being the Volume Weighted Average Price ("VWAP") of the Shares on the SIX Swiss Exchange Ltd between launch and pricing of the offering (translated into EUR using the prevailing EUR:CHF foreign exchange rate). The initial conversion price of the Bonds has been set at EUR 0.6953, a 27.5% premium above the Reference Share Price.

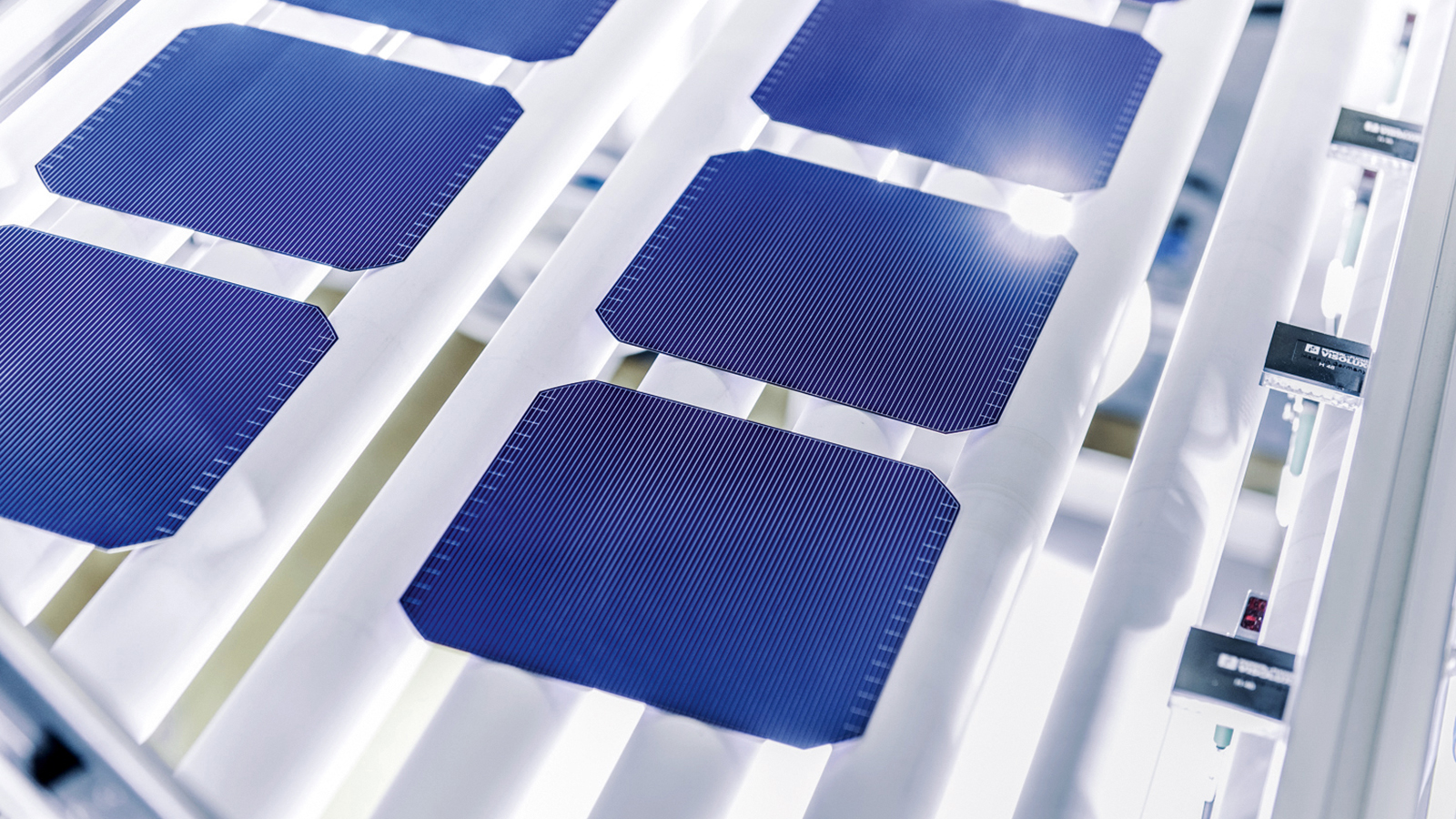

The net proceeds from the issue of the Bonds shall be used to finance and/or refinance investments in Eligible Green Projects as defined by the Company’s Green Financing Framework dated June 2021 including material and equipment sourcing and the ramp up of module and cell production in response to the expected acceleration of solar energy expansion.

The settlement and payment date of the Bonds is expected to be on or around May 17, 2023. The Bonds will not be listed or admitted to trading on the SIX Swiss Exchange or any other trading venue and no application has been made to list or admit the bonds to trading. Application for the listing and trading of the Bonds may be made at a later stage.

The Issuer and Meyer Burger have agreed to a 90-day lock-up period after the issuance of the Bonds, subject to customary exceptions and waiver by the syndicate banks.

Media contacts

Meyer Burger Technology AG

Anne Schneider

Head Corporate Communications

M. +49 174 349 17 90

anne.schneider@meyerburger.com

Dynamics Group AG

Andreas Durisch

Senior Couselor

T. +41 43 268 27 47

M. +41 79 358 87 32

adu@dynamicsgroup.ch