Meyer Burger's German subsidiary MBT Systems GmbH (the 'Issuer') launches a green senior unsecured guaranteed convertible bond to accelerate the next growth phase

Meyer Burger Technology AG (SIX: MBTN, 'Meyer Burger', the 'Company' or the ‘Guarantor’) today announces the launch of approx. EUR 230 million green senior unsecured guaranteed convertible bonds (the 'Bonds').

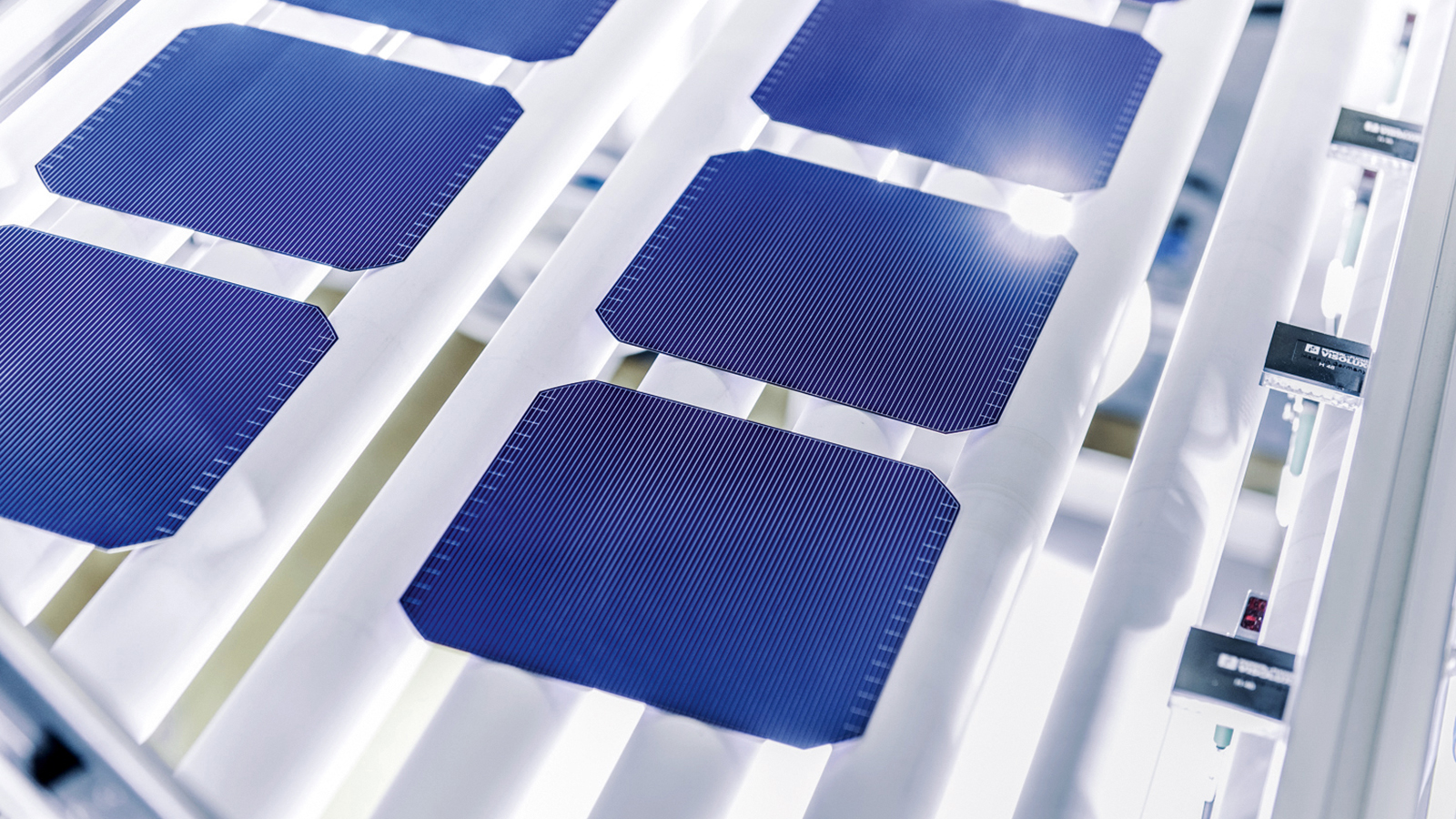

Meyer Burger is ready to accelerate the next growth phase, including the ramp-up of the production site in Goodyear, Arizona, USA. “The net proceeds from the bond issue shall be used to finance the material and equipment sourcing, and ramp-up of module and cell production in response to the expected acceleration of solar energy expansion, now that Europe, like the USA, is also looking to provide public incentives”, says CEO Gunter Erfurt.

Meyer Burger intends to place Bonds with an aggregate principal amount of approx. EUR 230 million that will be issued by the Issuer and guaranteed by the Company.

The Bonds will be issued with a denomination of EUR 100,000 per Bond at 100% of their principal amount and are expected to carry a coupon between 3.500% and 4.000% per annum, payable semi-annually in arrears. Unless previously converted or repurchased and cancelled, the Bonds will be redeemed at 100% of their principal amount on May 17, 2029.

The Bonds will be convertible into newly issued or existing registered shares of the Guarantor of currently CHF 0.05 nominal value each (the "Shares"), at an initial conversion price expected to be set at a premium between 25% and 30% over the volume weighted average price of the Shares on the SIX Swiss Exchange Ltd between launch and pricing of the offering (translated into EUR using the prevailing EUR:CHF foreign exchange rate). Shares issued or delivered upon conversion of the Bonds will have the same rights and entitlements as, and rank pari passu in all respects with, all other Shares of the Guarantor.

The net proceeds from the issue of the Bonds shall be used to finance and/or refinance investments in Eligible Green Projects as defined by the Guarantor’s Green Financing Framework dated June 2021 including material and equipment sourcing and the ramp-up of module and cell production in response to the expected acceleration of solar energy expansion.

Meyer Burger will be entitled to redeem the Bonds at their principal amount plus accrued interest in accordance with the terms and conditions of the Bonds at any time (i) on or after June 7, 2027, if the price of a Share is equal to or exceeds 130% of the then prevailing conversion price over a certain period or (ii) if less than 15% of the aggregate principal amount of the Bonds remain outstanding.

The offering of the Bonds will be conducted as a private placement to professional clients in Switzerland and to investors outside the US (in reliance on Regulation S under the US Securities Act of 1933, as amended), and in compliance with the laws and regulations applicable in every country where the offering takes place.

The Bonds are expected to price later today. The settlement and payment date of the Bonds is expected to be on or around May 17, 2023. The Bonds will not be listed or admitted to trading on the SIX Swiss Exchange or any other trading venue and no application has been made to list or admit the bonds to trading. Application for the listing and trading of the Bonds may be made at a later stage.

The Issuer and Meyer Burger have agreed to a 90-day lock-up period after the issuance of the Bonds, subject to customary exceptions and waiver by the syndicate banks.

Media contacts

Meyer Burger Technology AG

Anne Schneider

Head Corporate Communications

M. +49 174 349 17 90

anne.schneider@meyerburger.com

Dynamics Group AG

Andreas Durisch

Senior Counselor

T. +41 43 268 27 47

M. +41 79 358 87 32

adu@dynamicsgroup.ch