Press Release

Thun, 21 March 2019

Meyer Burger – Strategic partnership with Oxford PV; Fiscal year 2018 results; Re-sized Executive Board

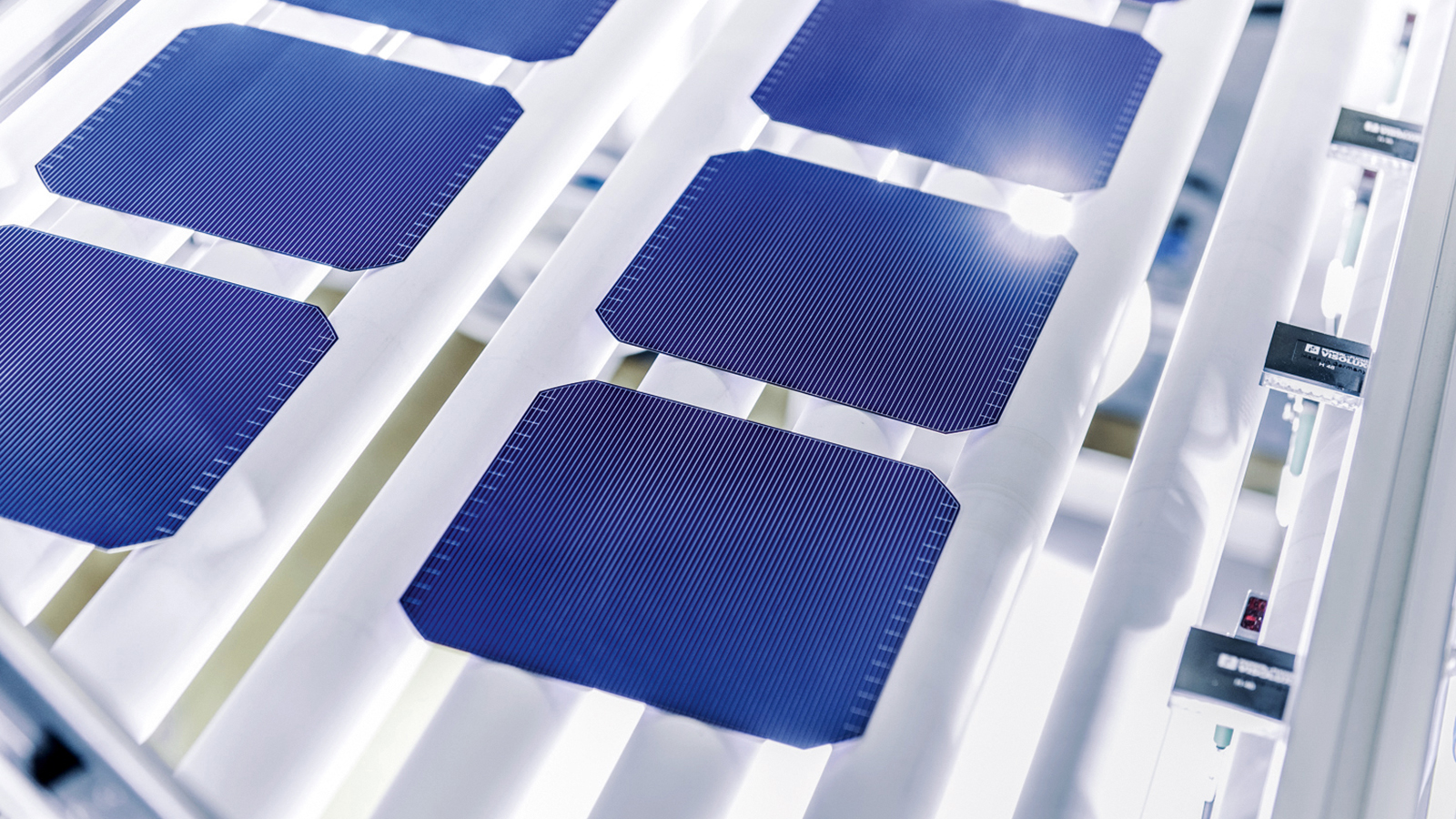

Meyer Burger Technology Ltd (SIX Swiss Exchange: MBTN) and Oxford Photovoltaics Limited (Oxford PV) have entered into a strategic partnership and signed an exclusive cooperation agreement to jointly accelerate the development of mass production technology for perovskite on silicon Heterojunction (HJT) tandem cells.

Oxford PV was founded in 2010 as a spin-out from University of Oxford in England. They have developed perovskite tandem solar cells using bottom cells of crystalline silicon and achieved a certified world-record efficiency of 28% in 2018. Such tandem devices use the higher energy blue part of the solar spectrum more effectively, allowing a theoretical efficiency limit of 43% compared to 29% for traditional single-junction silicon-based solar cells. Perovskite tandem solar cells are viewed in the solar industry as the next generation in solar cell technology enabling the reduction of the cost of solar energy (LCOE) to unprecedented levels. Among experts, Oxford PV is regarded as the leading global company for perovskite tandem solar cells. Its technology and material know-how is protected by a patent portfolio of over 200 patents.

In order to accelerate the industrialization of this promising technology, Meyer Burger and Oxford PV agreed to combine Meyer Burger’s leading Heterojunction (HJT) and SmartWire Connection (SWCTTM) technology with Oxford PV’s unrivaled perovskite solar cell technology. Meyer Burger will sell a 200 MW HJT line for the pilot production of tandem cells which will be ramped up by the end of 2020 in Oxford PV’s Brandenburg an der Havel facility. The initial tandem solar cell efficiency target for the 200 MW pilot production line will be 27%. The characteristics of Meyer Burger’s HJT cells make them the perfect bottom cells for Oxford PV’s perovskite top cell layers. Meyer Burger’s SWCT® is the ideal technology, connecting the new perovskite on HJT tandem cells into reliable and highly efficient solar modules. Meyer Burger will also develop equipment to industrialize the mass production of the respective perovskite layers which are deposited onto HJT bottom cells. This further accelerates the time-to-market and enlarges Oxford PV’s and Meyer Burger’s advantage as perovskite and HJT technology leaders in the global solar industry.

To underscore this strategic partnership, Meyer Burger will take a stake in Oxford PV of up to 18.8% of capital through the issue of up to 62.29 million new Meyer Burger registered shares from the company’s existing authorised capital (up to 9.99% of the currently listed share capital of Meyer Burger). As a result, Meyer Burger will become the largest shareholder of Oxford PV. Furthermore, Meyer Burger was granted the option to increase its shareholding in the course of the joint development agreement at the same valuation price to 31.6% of capital and 24.0% of voting rights in Oxford PV. As strategic investor, Meyer Burger will be granted special corporate governance rights and Hans Brändle, Meyer Burger CEO, will become member of the Board of Directors of Oxford PV.

Meyer Burger plans to issue the newly issued shares out of its existing authorised capital (no lock-up). The closing of the transaction is expected by the end of April 2019.

Fiscal year 2018 results

For the PV manufacturing industry, 2018 turned out to be a challenging year. It started in January 2018 with the announcement by the US president that steep tariffs on imported solar panels would be introduced, followed by an intensifying trade dispute between the USA and China which affected many companies and industries worldwide. Furthermore, on 31 May 2018, the Chinese government announced substantial subsidy cuts in the solar industry. Despite the positive long-term outlook for the solar industry, these facts have created a lot of uncertainties and led to a significant reluctance by customers to invest in PV manufacturing equipment. The market started to show signs of recovery towards the end of the year.

After a very successful 2017 with strong order intake for Meyer Burger’s PERC technologies, the Company has made the experience that Chinese customers seem to put additional emphasis on buying PV manufacturing equipment locally, whenever possible. Despite Meyer Burger’s leading position with regards to “Cost of Ownership”, the discussion on “CAPEX per GW” has intensified, putting pressure on selling prices for manufacturing equipment while at the same time higher throughput has to be guaranteed.

Against the background of the political environment and the margin pressure seen for standard PV business solutions, Meyer Burger achieved incoming orders of CHF 326.8 million in 2018 (2017: CHF 560.7 million). Larger orders in 2018 represented CHF 122 million (including a CHF 74 million Heterojunction/SWCT® order in December 2018) compared to CHF 243 million in the previous year (also including a CHF 45 million Heterojunction order in October 2017). The total order backlog as at 31 December 2018 stood at CHF 240.5 million (31.12.2017: CHF 343.8 million).

Net sales reached CHF 407.0 million (2017: CHF 473.3 million). Compared to the previous year, the divestment of the Solar Systems business to 3S Solar Plus AG in June 2018 had a negative effect of about CHF 10.2 million, compensated by positive currency effects (mainly EUR) of MCHF 15.2 million. On a comparable basis, the continuing business declined by CHF 71.3 million or 15% in 2018.

Operating income after costs of products and services reached CHF 200.8 million (2017: CHF 194.8 million), reflecting a margin of 49.3% (2017: 41.2%).

Personnel expenses declined by CHF 9.8 million or 7% compared to the previous year and were CHF 125.9 million (2017: CHF 135.7 million), as Meyer Burger continued to flexibilise its organisation and to significantly reduce its fixed cost base. Other operating expenses amounted to CHF 48.8 million, including one-time charges of CHF 4.3 million in conjunction with the divestment of the Solar Systems business activities (2017: CHF 46.7 million). Without this one-time charge, other operating expenses would also have declined by about 5%.

EBITDA reached CHF 26.1 million in fiscal year 2018 (2017: CHF 12.4 million), resulting in an EBITDA margin of 6.4% (2017: margin of 2.6%). Depreciation and amortisation came to a total of CHF 24.3 million (2017: CHF 31.7 million) and have declined in line with expectations. The result at EBIT level amounted to CHF 1.8 million (2017: CHF -19.3 million).

The financial result, net, was CHF -9.8 million (2017: CHF -10.3 million). The extraordinary result amounted to CHF +0.7 million, mainly in conjunction with subsequent costs and effects of the change in estimates in connection with the discontinuation of production activities at the Thun site announced in 2017 (2017: CHF -48.8 million, mainly in conjunction with the divestment of DMT and related goodwill recycling as well as costs in relation to the reorganisation and discontinuation of manufacturing activities in Thun).

Tax expenses were CHF 52.1 million (2017: tax expenses of CHF 0.9 million). The tax expenses in 2018 include value adjustments on deferred tax assets in a total amount of CHF 49.0 million. Tax expenses in 2018 related to current income taxes on profits for the period were CHF -4.4 million and deferred income taxes CHF +1.3 million.

Due to the highly negative impact of the adjustments on deferred tax assets (CHF 49.0 million), the net loss for fiscal year 2018 was only slightly reduced to CHF -59.4 million (2017: CHF -79.3 million).

The balance sheet total declined compared to the previous year, mainly because of lower customer prepayments due to the reduced order intake and the value adjustments on deferred tax assets. The balance sheet amounted in total to CHF 349.2 million as at 31 December 2018 (31.12.2017: CHF 470.0 million). Cash and cash equivalents were CHF 89.8 million, inventories CHF 78.6 million, property, plant and equipment CHF 82.3 million, intangible assets CHF 11.9 million and deferred tax assets CHF 27.7 million.

Total liabilities came to CHF 167.4 million, of which trade payables were CHF 17.3 million, customer prepayments CHF 34.4 million, provisions CHF 14.1 million and financial liabilities CHF 55.6 million. The financial liabilities include a loan in an amount of CHF 30.0 million secured by mortgage certificates (on building in Thun), a value of CHF 25.3 million for the remaining convertible bonds that have not been converted yet and CHF 0.3 million of other loans.

Equity stood at CHF 181.7 million as at 31 December 2018 (31.12.2017: CHF 243.0 million). The equity ratio at year-end 2018 was 52.0% (31.12.2017: 51.7%).

Re-sized Executive Board

In line with the company’s strategic focus on cell/module technologies, the Executive Board will be re-sized from five to four members. Daniel Lippuner, COO, will leave the Executive Board by the end of June 2019. The Board of Directors and the Executive Board would like to thank Daniel Lippuner for his achievements and contributions as well as his strong commitment to Meyer Burger and wish him all the best for his future.

Outlook for 2019

It is difficult to predict 2019, due to political uncertainties, such as trade tariffs, energy policies and new Chinese subsidy policies which have not yet been released. The signed divestment of the wafering business is expected to close within weeks and generates CHF 50 million proceeds.

Meyer Burger remains confident in relation to the development of the heterojunction and SmartWire Connection equipment business, which has been further validated by the order from and joint roadmap development with top-tier PV player REC Group, the cooperation with Oxford PV and the substantially increasing sales pipeline for HJT over the past months. Meyer Burger also sees the accelerating market interest in TOPCon as the next upgrade technology beyond PERC. Since its breakthrough at the end of 2018, Meyer Burger is experiencing increased customer interest in its CAiA® as the proprietary solution for TOPCon. On the back of China’s anticipated new energy policies and demand from outside China, management expects 2019 to be the inflection point for these new technologies with attractive gross margins starting to replace PERC. Meyer Burger, as the leader in high efficiency cell and module technologies, is expected to be the main beneficiary of such advanced technology buys. Today’s announced partnership with Oxford PV further underscores Meyer Burger’s strategy to drive the PV technology roadmap.

Contacts:

Ingrid Carstensen

Head of Corporate Communications

Phone: +41 (0)33 221 28 34

ingrid.carstensen@meyerburger.com

Stefan Diepenbrock

Senior Corporate Communications Manager

Phone: +41 (0)33 221 27 85

stefan.diepenbrock@meyerburger.com

KEY FIGURES FISCAL YEAR 2018

|

Consolidated income statement in TCHF |

2018 |

2017 |

|

Net sales |

406 967 |

473 256 |

|

Operating income after costs of products and services |

200 763 |

194 818 |

|

in % of net sales |

49.3% |

41.2% |

|

EBITDA |

26 097 |

12 364 |

|

in % of net sales |

6.4% |

2.6% |

|

EBIT |

1 751 |

-19 308 |

|

in % of net sales |

0.4% |

-4.1% |

|

Financial result |

-9 815 |

-10 346 |

|

Extraordinary result |

687 |

-48 834 |

|

Earnings before taxes |

-7 376 |

-78 488 |

|

Income taxes |

-52 061 |

-851 |

|

Net result |

-59 437 |

-79 339 |

|

Consolidated balance sheet in TCHF |

31.12.2018 |

31.12.2017 |

|

Total assets |

349 153 |

469 983 |

|

Current assets |

226 669 |

275 930 |

|

Non-current assets |

122 485 |

194 052 |

|

Liabilities |

167 442 |

227 026 |

|

Equity |

181 711 |

242 957 |

|

Equity ratio |

52.0% |

51.7% |

|

Consolidated cash flow statement in TCHF |

2018 |

2017 |

|

Cash flow from operating activities |

-23 369 |

12 761 |

|

Cash flow from investing activities |

-5 100 |

2 464 |

|

Cash flow from financing activities |

-5 118 |

-139 026 |

|

Change in cash and cash equivalents |

-33 587 |

-123 801 |

|

Currency translation effects on cash and cash equivalents |

-1 314 |

2 075 |

|

Cash and cash equivalents at the end of the period |

89 799 |

124 700 |

|

Number of employees (FTEs) as of 31 December |

1 191 |

1 276 |

The Annual Report 2018 and the investors‘ presentation for the full year results are available for download on the company website www.meyerburger.com under – Investor Relations – Financial Reports & Publications.

https://www.meyerburger.com/ch/en/meyer-burger/investor-relations/financial-reports-publications/