Press Release

Thun, 15 August 2019

Meyer Burger impacted by weak demand in photovoltaic sector in H1 2019

Meyer Burger Technology AG (SIX Swiss Exchange: MBTN) reports business performance in the first half year 2019 below expectation. The solar sector was marked by weak demand in China, the largest end customer market, during the first half of 2019. A global surplus in production capacity for multicrystalline wafers, cells and modules was accompanied by supply bottlenecks for high-efficiency mono-products. Although investments in standard PV increased because of declining prices for PERC equipment, cell and module manufacturers often postponed major investment decisions in new technologies.

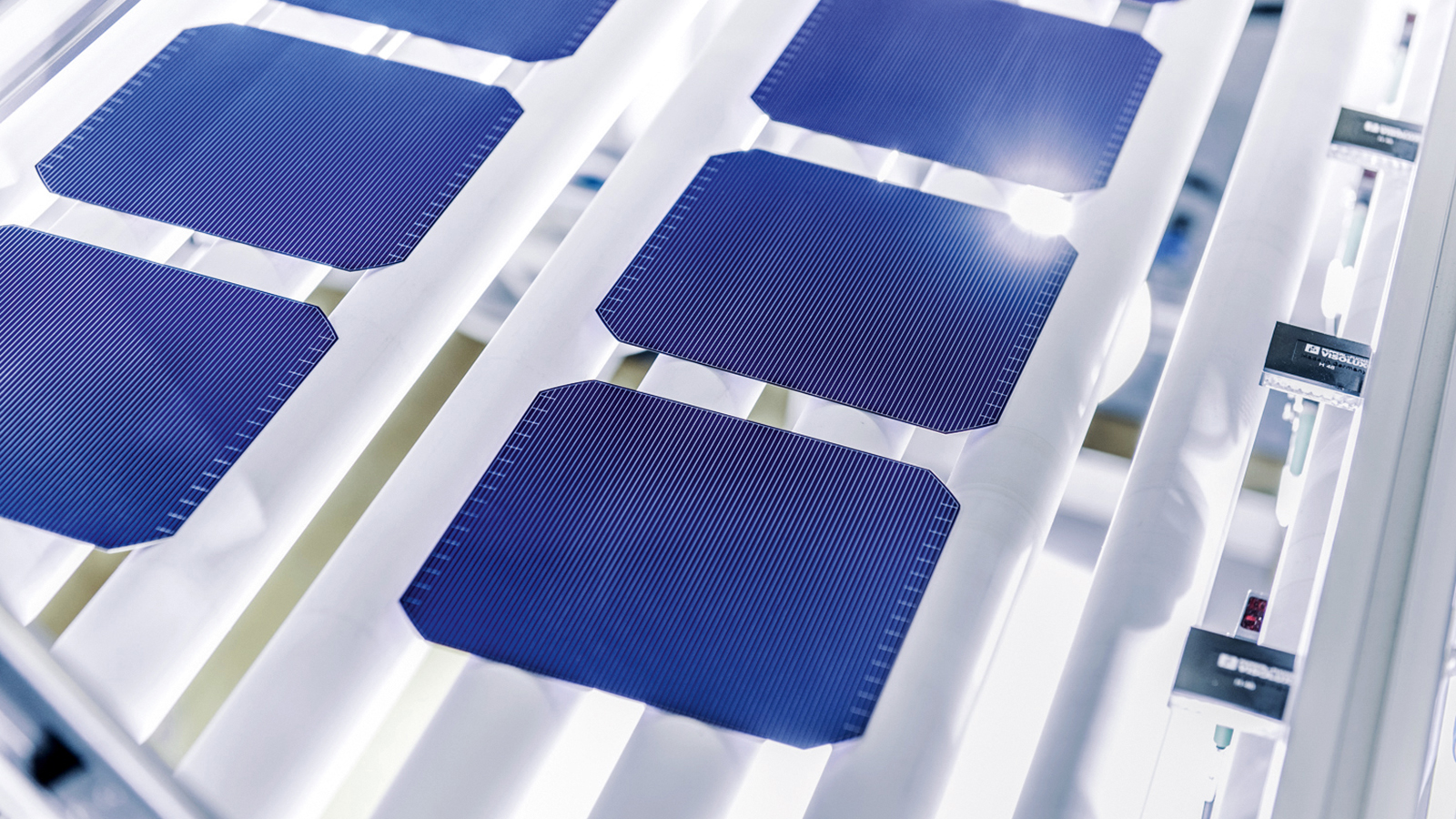

The transformation programme launched in October 2018 is on track to achieve its key objectives and is constantly being adapted to market dynamics. Thanks to the sale of non-core businesses and substantial cost reductions in continuing operations, the break-even level is falling steadily. Hans Brändle, CEO of Meyer Burger, commented: »Against the backdrop of this slump in the market, we focused on implementing our strategic priorities: further developing our leading production solutions for heterojunction (HJT) and SmartWire Connection Technology (SWCT®). The first manufacturing line will begin series production soon. We believe the major market interest in our technology will translate into real orders. However, the significant decline and unattractive margins in standard PV business have prompted us to review the originally planned relocation of some of our production to China and to adapt our sales focus. We intend to concentrate our future PV business activities mainly at our largest location, Hohenstein-Ernstthal (Germany).»

In a difficult market environment dominated by the US-China trade dispute and the Chinese government’s unclear solar funding policy, Meyer Burger achieved incoming orders of CHF 94.0 million (CHF 137.9 million in H1 2018). Adjusted for the sale of the wafering business, incoming orders remained stable (-0.6%). Orders on hand as at 30 June 2019 amounted to CHF 166 million (31.12.2018 CHF 241 million ). The book-to-bill ratio was 0.77 for the first half of 2019 (0.59 in H1 2018).

Net sales dropped to CHF 122.6 million compared to the previous year (CHF 232.3 million in H1 2018, adjusted by CHF 193.4 million for the sale of the wafering business). Negative currency effects accounted for around CHF -3.5 million or -2.8%. Adjusted for currency effects and the sale of the wafering business, the organic decline in sales for continuing business was 36.8%. The regional sales mix has changed slightly from the previous year, although Asia remains the most important sales region for Meyer Burger: Asia accounted for 73% of net sales during the first half of 2019 (68% in H1 2018), while Europe accounted for 21% (28% in H1 2018) and the Americas provided approx. 6% (3% in H1 2018).

Operating income after costs of products and services was CHF 63.1 million (CHF 120.1 million in H1 2018), with a margin of 51.5% during the first half of 2019 (51.7% in H1 2018).

Personnel expenses dropped by CHF 6.9 million or 10.7% compared to the previous year, to CHF 57.4 million (CHF 64.2 million in H1 2018). These costs fell because Meyer Burger managed to organize the company even more flexibly and because the Group sold its wafering business in late April 2019. Other operating expenses stood at CHF 18.9 million (-28.9% compared to H1 2018).

Due to the decline in sales, EBITDA was below the level achieved during the same period in the previous year. The figure was CHF -13.2 million in the first half of 2019 (CHF +29.2 million in H1 2018). The result at the EBIT level amounted to CHF -21.1 million (CHF +14.9 million in H1 2018).

The net financial result in the first half of 2019 amounted to CHF -4.5 million (CHF -4.0 million in H1 2018). The extraordinary result in the first half of 2019 amounted to CHF +27.7 million (CHF +0.8 million in H1 2018). This increase is mainly due to the sale of the wafering business to Precision Surfacing Solutions (PSS). Tax expenses in the first half of 2019 stood at CHF 0.3 million (CHF 3.4 million in H1 2018).

Meyer Burger generated a group result of CHF +1.8 million in the first half of 2019 (CHF +8.3 million in H1 2018).

Balance sheet as at 30 June 2019

The balance sheet total stood at CHF 350.3 million (31.12.2018 CHF 349.2 million). Cash and cash equivalents stood at CHF 31.7 million, inventories at CHF 66.2 million, property, plant and equipment at CHF 76.4 million, intangible assets at CHF 8.9 million and deferred tax assets at CHF 20.7 million.

Total liabilities came to CHF 130.3 million, primarily comprising trade payables of CHF 27.3 million, customer prepayments of CHF 14.7 million, provisions of CHF 7.1 million and financial liabilities of CHF 39.4 million. Equity stood at CHF 220.0 million (31.12.2018 CHF 181.7). The equity ratio was 62.8% as at June 30, 2019 (31.12.2018 52.0%).

Cash flow

In the first half of 2019, the company had negative cash flow from operations of CHF -57.6 million (CHF -16.4 million in H1 2018). This negative cash flow from operations is mainly attributable to an increase in net working capital. Cash flow from investing activities was CHF +17.7 million as a result of the sale of the wafering business and a cash deposit of CHF 30 million to secure the guarantee facility (CHF -1.9 million in H1 2018). This caused free cash flow to reach CHF -39.9 million (CHF -18.3 million in H1 2018). Cash flow from financing activities stood at CHF -18.1 million (CHF -4.2 million in H1 2018), comprising the repayment of financial liabilities

Outlook

The medium and long-term growth outlook for the solar industry has continued to improve against the backdrop of current concerns over climate change. Solar power is already the most affordable technology in many regions today, offering a uniquely wide range of applications and the greatest potential for cost reduction among relevant electricity generation technologies. After a lull in growth during the last 12 months due to restructuring of funding for China’s solar market, significant double-digit expansion in global installed solar power output is now forecast to return. Meyer Burger believes that more than half of this solar power capacity will be installed outside China. The growth forecast for the coming years in new and established western markets will also result to new local PV production capacities.

Hans Brändle commented the outlook: »Meyer Burger will continue to make substantial investments in research and development in order to remain a market leader in the premium segment. With our focus on developing high-efficiency industrial HJT production solutions, we have achieved record cell efficiency of over 24.7% in commercialized HJT systems. We are already working on a roadmap for HJT cells with even higher levels of efficiency. The collaboration with REC will lead to a quantum lead in the manufacture of HJT / SmartWire modules.

Half-year results 2019 and Half-Year Report 2019

Meyer Burger issues the Half-Year Report 2019 in accordance with the guidelines of Swiss GAAP FER 31 (Supplementary Accounting and Reporting Recommendations for Listed Companies). The report is available in German and English at www.meyerburger.com > Investors > Reports & Presentations.

Contacts:

Ingrid Carstensen

Head of Corporate Communications

Tel: +41 (0)33 221 28 34

ingrid.carstensen@meyerburger.com

Stefan Diepenbrock

Senior Corporate Communications Manager

Tel: +41 (0)33 221 27 85

stefan.diepenbrock@meyerburger.com

KEY FIGURES 1ST HALF-YEAR 2019

|

in TCHF |

H1 2019 |

H1 2018 |

|

Order intake |

94 939 |

137 910 |

|

Order backlog |

165 737 |

240 911 |

|

Net sales |

+122 567 |

+232 328 |

|

Operating income after costs of products and services |

+63 099 |

+120 064 |

|

in % of net sales |

+51.5% |

+51.7% |

|

EBITDA |

-13 159 |

+29 241 |

|

in % of net sales |

-10.7% |

+12.6% |

|

EBIT |

-21 140 |

+14 881 |

|

in % of net sales |

-17.2% |

+6.4% |

|

Financial results, result from investments in associates |

-4 546 |

-3 979 |

|

Extraordinary result |

+27 676 |

+831 |

|

Earnings before taxes |

+2 052 |

+11 732 |

|

Income taxes |

-269 |

-3 440 |

|

Result |

1 783 |

+8 292 |

|

Balance sheet in TCHF |

30.06.2019 |

31.12.2018 |

|

Total assets |

350 314 |

349 153 |

|

Current assets |

176 942 |

226 669 |

|

Non-current assets |

173 372 |

122 485 |

|

Liabilities |

130 265 |

167 442 |

|

Equity |

220 049 |

181 711 |

|

Equity ratio |

62.8% |

52.0% |

|

Cash flow statements in TCHF |

H1 2019 |

H1 2018 |

|

Cash flow from operating activities |

-57 555 |

-16 378 |

|

Cash flow from investing activities |

+17 674 |

-1 950 |

|

Cash flow from financing activities |

-18 068 |

-4 164 |

|

Change in cash and cash equivalents |

-57 949 |

-22 492 |

|

Currency translation differences on cash and cash equivalents |

-162 |

-236 |

|

Cash and cash equivalents at end of period |

31 688 |

101 972 |

|

Number of staff (FTE) as at 30. Juni |

999 |

1 227 |