NOT FOR PUBLICATION, DISTRIBUTION OR RELEASE, DIRECTLY OR INDIRECTLY, IN OR INTO THE UNITED STATES OF AMERICA, CANADA, AUSTRALIA OR JAPAN OR ANY OTHER JURISDICTION IN WHICH THE DISTRIBUTION OR RELEASE WOULD BE UNLAWFUL

Meyer Burger calls EGM to approve CHF 200 to 250 million rights issue to finance the completion of its Colorado and Arizona manufacturing facilities and halts production at Freiberg site in preparation for closure

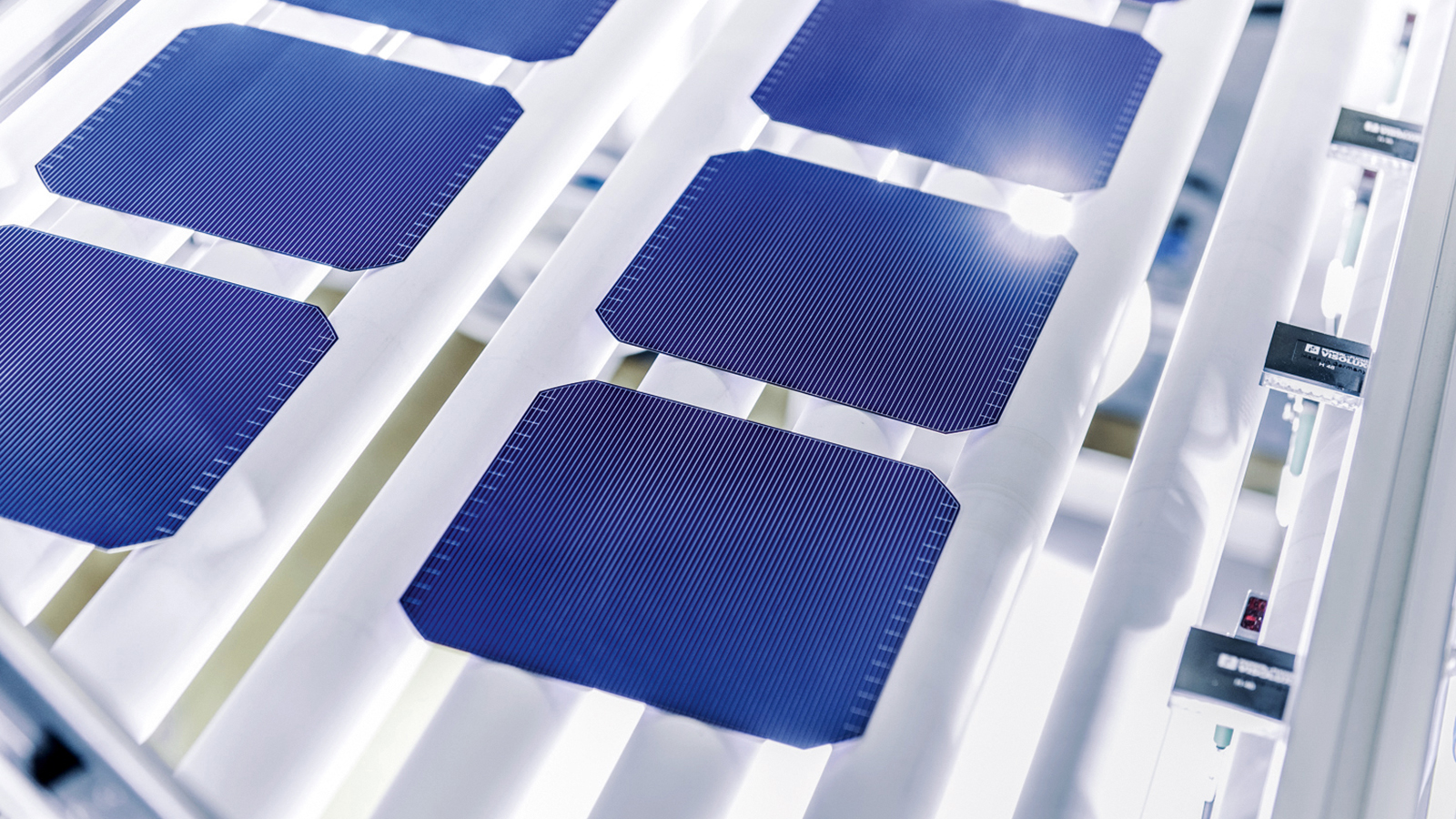

Meyer Burger Technology AG (the “Company” and, together with its subsidiaries, “Meyer Burger” or the “Group”), a long-time pioneer and technology leader in the global photovoltaic industry, today presents an important update on its plan, announced on January 17, aiming to stop sustained losses in Europe and to take advantage of the highly attractive U.S. market. Implementation of the plan is expected to close the funding gap of CHF 450 million, which is expected to enable the Group to become cash flow positive in the mid-term. The Company will shortly publish an invitation to an Extraordinary General Meeting (“EGM”) to be held on March 18, 2024, to approve a rights issue targeting gross proceeds of CHF 200 million to CHF 250 million. The rights issue is expected to include the offering of Subscription Rights (as defined below) and newly issued shares in the Company. For details relating to the rights issue, see below “Information on Planned Capital Increase Through a Rights Offering” and “General Information on the Transaction”.

In parallel and following a detailed due diligence process, the federal government of Germany has approved an export agency credit guarantee for financing to be provided by a commercial bank with a targeted amount of up to USD 95 million. Funding is expected to occur following the entry into long-form credit documentation and the satisfaction of customary conditions precedent. The facility is expected to have a ten-year tenor. In addition, Meyer Burger is targeting an advanced manufacturing production tax credit (so-called 45X) financing in the amount of up to USD 300 million, with a term of 5 to 6 years, to be provided by a leading global investment bank that has provided initial non-binding terms. The first disbursements are targeted for end of Q2 2024 and subject to due diligence and the entering into requisite binding agreements. The Company believes the 45X financing is feasible based on the partial monetization of an estimated USD 1.4 billion in future tax credits.

Moreover, Meyer Burger continues to pursue additional financing options, including a USD 200 million to USD 250 million U.S. Department of Energy (“DOE”) guaranteed loan from the Federal Financing Bank under the Title 17 Clean Energy Financing Loan Program. After successfully completing Part I of the DOE process, the Group was formally invited in February 2024 to submit Part II of an application for such loan. The DOE’s invitation to submit a Part II application is not an assurance that the DOE will invite the applicant into the due diligence and term sheet negotiation process, that the DOE will offer a term sheet to the applicant, or that the terms and conditions of a term sheet will be consistent with terms proposed by the applicant. The foregoing matters are wholly dependent on the results of the DOE review and evaluation of a Part II application, and the DOE’s determination whether to proceed.

The Group expects to use the proceeds from these potential additional sources of financing, together with proceeds from the rights issue, primarily to complete its solar cell manufacturing facility in Colorado Springs, Colorado (United States) and its solar module manufacturing site in Goodyear, Arizona (United States), both of which are currently under construction, with a targeted nominal annual production capacity of approximately 2 GW each.

While not all of the aforementioned additional sources of financing are needed simultaneously, the Group would be able to close the funding gap of CHF 450 million, first announced on January 17, 2024, with a combination of the rights issue, the export agency credit guarantee and either the 45X or the DOE loan. The Group estimates that the proceeds from a financing backed by the already approved export agency credit guarantee and the other potential sources of financing will, if and when received as currently anticipated, together with the proceeds from the rights issue, enable it to open its U.S. cell manufacturing facility around year-end 2024 and its U.S. module manufacturing facility in the second quarter of 2024, as per the schedule previously communicated. Assuming these cell and module manufacturing sites become operational as planned, the Group anticipates that it will be in a position to generate an annual EBITDA of approximately CHF 250 million in the mid-term from its operations in the United States.

Meyer Burger further resolved that it will not start implementing certain capex investments with respect to the completion of its solar cell manufacturing facility in Colorado Springs for so long as there is uncertainty regarding the availability and successful implementation of the additional financing options. Such an adjustment of the completion schedule for the solar cell manufacturing facility in Colorado is possible in principle, without adversely affecting the ramp-up of the Group’s solar module manufacturing in Goodyear, as solar cells are expected to be supplied from other sources in the meantime, including the Group’s solar cell manufacturing site in Thalheim (city of Bitterfeld-Wolfen, Saxony-Anhalt, Germany).

Gunter Erfurt, CEO of Meyer Burger, explained: “I am pleased that today we are making concrete progress on our approach outlined on January 17. The rights issue is an attractive proposal to our investors as they can invest into the highly attractive U.S. business where we are positioned to have the potential to grow a profitable business. Furthermore, a clearer focus on our U.S. business makes us independent of political decisions in Europe”.

Franz Richter, Chairman of the Board of Directors, stated: “The plan presented enables Meyer Burger to capitalize on its world-leading technological position to drive commercial success, deliver returns for investors and supply great products to our customers”.

As there has not yet been any decision on policy support measures to remediate current market distortions created by oversupply and dumping prices of solar modules, the Group has decided to start preparations for the closure of its Freiberg site, which would take effect in April. As a first step, the Group will halt production at the site in the first half of March, which is expected to result in significant cost savings from April onwards. Sales activities in Europe are unaffected, and customers will continue to receive full-product warranties for up to 30 years as usual.

Sentis Capital Cell 3 PC, the Group’s largest shareholder which, to the Group’s knowledge, holds 10.01% of the shares of Meyer Burger, has stated to the Group that it intends to invest up to CHF 50 million in the equity financing, subject to Meyer Burger deciding on the future of its German operations before the EGM in March, and subject to the final terms of the Offering (as defined below). The investment amount of CHF 50 million would be reached by exercising all of Sentis Capital Cell 3 PC’s Subscription Rights, and in the remaining amount to which Sentis Capital Cell 3 PC would purchase additional shares in the Offering with respect to which Subscription Rights have not been exercised.

The Board of Sentis Capital Cell 3 PC explained: “Due to a lack of European protection against unfair competition from China, nearly four years of hard work by great employees in Europe is at risk. At the same time, Meyer Burger is rapidly approaching the opening of its module factory in Arizona and is constructing a 2 GW cell factory in Colorado. The U.S. policy framework has proven several times that there is a strong bipartisan commitment to protect U.S.-based companies against unfair competition. We also have great respect for and trust in the people and the management team of Meyer Burger. That is why Sentis Capital Cell 3 PC, as a shareholder, is once more prepared to support Meyer Burger to realize the benefits of a very profitable business case in the United States, already backed by long-term offtake commitments”.

Daniel Menzel, Chief Operating Officer of Meyer Burger, added: “All of our experience from the successful ramp-up of production in Germany, the high product quality achieved and the excellent production key performance indicators in Germany that we have accomplished over the past three years will now be utilized to ramp up solar module production in the United States as quickly as possible in order to swiftly supply our offtake partners”.

With their respective shareholdings, the members of the Company’s Board of Directors and the Group’s Executive Committee intend to participate in the capital increase by exercising their respective Subscription Rights.

In parallel, Meyer Burger continues to pursue potential strategic partnerships with companies that could provide funding assistance, support industrialization and drive revenue through customer access, possible exposure to new geographies and/or technology licensing. Those potential partnership business models could help drive higher long-term growth and reduce capital intensity.

Information on Planned Capital Increase Through a Rights Offering

The Group is planning to launch an offering (the “Offering”) of Subscription Rights (as defined below) and newly issued shares of the Company (the “Shares”). The Offering is expected to comprise a rights offering pursuant to which holders of existing shares in the Company, subject to certain limitations, will receive rights to subscribe for offered Shares at a certain price on a pro rata basis (whereby fractions of subscription rights do not entitle the holder to acquire one Share) (the “Subscription Rights”). It is intended that the Subscription Rights can be traded on SIX Swiss Exchange. The Offering is also expected to comprise a rump placement of any unsubscribed Shares. Meyer Burger expects to enter into a subscription and share placement agreement with a syndicate of banks. The Offering is expected to involve (i) a public offering in Switzerland and (ii) private placements to certain qualified investors outside Switzerland and the United States.

The Offering shall be implemented through an ordinary capital increase targeting gross proceeds of CHF 200 million to CHF 250 million. The Company expects to use the proceeds from the Offering primarily to finance the expansion of the production capacity for the PV cell and module production in the United States and the related production and distribution structures and for general corporate purposes. The Board proposes to the EGM an ordinary capital increase, as will be detailed in the invitation to the EGM, for purposes of the Offering.

General Information on the Transaction

The maximum amount of the ordinary capital increase and the maximum number of new Shares to be issued, the subscription ratio and the subscription price will be determined and announced by the Board of Directors shortly before the EGM. These and other conditions of the Offering approved by the EGM will be included in a prospectus, which is expected to be published on March 19, 2024. The subscription period is expected to start on March 20, 2024 and end on March 28, 2024 at 12:00 noon CET. Trading of the Subscription Rights at the SIX Swiss Exchange is expected to start on March 20, 2024 and end on March 26, 2024. The Board of Directors reserves the right to amend this timeline.

At the beginning of the subscription period, custodian banks are expected to automatically credit Subscription Rights to the deposit accounts of eligible shareholders. Eligible shareholders should direct any questions regarding the exercise of their Subscription Rights to their custodian banks.

A webcast incl. a conference call in English will take place today at 10:00 CET.

Webcast 10:00 CET (English)

You can follow the webcast under the following link:

https://www.webcast-eqs.com/meyerburger-2024-feb

(Audio and presentation in web browser)

Please use the following link to register to ask questions via conference call:

https://webcast.meetyoo.de/reg/xwqUpIkV4I2X

Media contact

Meyer Burger Technology AG

Anne Schneider

Head Corporate Communications

M. +49 174 349 17 90

anne.schneider@meyerburger.com

Alexandre Müller

Investor Relations

M. +41 43 268 3231

alexandre.mueller@meyerburger.com

This publication may contain specific forward-looking statements, e.g. statements including terms like “believe”, “assume”, “expect”, “forecast”, “project”, “may”, “could”, “might”, “will” or similar expressions. Such forward-looking statements are subject to known and unknown risks, uncertainties and other factors which may result in a substantial divergence between the actual results, financial situation, development or performance of Meyer Burger Technology AG and those explicitly or implicitly presumed in these statements. Against the background of these uncertainties, readers should not rely on forward-looking statements. Meyer Burger Technology AG assumes no responsibility to update forward-looking statements or to adapt them to future events or developments. Except as required by applicable law, Meyer Burger Technology AG has no intention or obligation to update, keep updated or revise this publication or any parts thereof following the date hereof.

Important Notice

This document is not an offer to sell or a solicitation of offers to purchase or subscribe for any securities. This document is not a prospectus within the meaning of the Swiss Financial Services Act and not a prospectus under any other applicable laws. Copies of this document may not be sent to jurisdictions, or distributed in or sent from jurisdictions, in which this is barred or prohibited by law. The information contained herein shall not constitute an offer to sell or the solicitation of an offer to buy any securities, in any jurisdiction in which such offer or solicitation would be unlawful prior to registration, exemption from registration or qualification under the securities laws of any jurisdiction.

A decision to invest in securities of Meyer Burger Technology AG should be based exclusively on the prospectus to be published by Meyer Burger Technology AG for such purpose. Copies of such prospectus (and any supplements thereto) will be available free of charge in Switzerland from Meyer Burger Technology AG, with registered address and head office at Schorenstrasse 39, 3645 Gwatt (Thun), Switzerland, Tel.: +41 33 221 28 00, Email: mbinfo@meyerburger.com.

This document is not for publication or distribution in the United States of America (including its territories and possessions, any State of the United States and the District of Columbia), Canada, Japan or Australia or any other jurisdiction into which the same would be unlawful. This document does not constitute an offer or invitation to subscribe for or purchase any securities in such jurisdictions or in any other jurisdiction into which the same would be unlawful. In particular, the document and the information contained herein should not be distributed or otherwise transmitted into the United States of America or to publications with a general circulation in the United States of America. The securities referred to herein have not been and will not be registered under the U.S. Securities Act of 1933, as amended (the Securities Act), or the laws of any state, and may not be offered or sold in the United States of America absent registration under or an exemption from registration under the Securities Act. There will be no public offering of the securities in the United States of America.

The information contained herein does not constitute an offer of securities to the public in the United Kingdom. No prospectus offering securities to the public will be published in the United Kingdom. This document is only being distributed to and is only directed at persons who (i) are outside the United Kingdom or (ii) are “qualified investors” within the meaning of article 2 of the Prospectus Regulation (Regulation (EU) 2017/1129) as it forms part of domestic law by virtue of the European Union (Withdrawal) Act 2018 who are also (A) investment professionals falling within Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005, as amended from time to time (the FSMA Order) or (B) high net worth entities falling within Article 49(2)(a) to (d) of the FSMA Order (all such persons being referred to as “relevant persons”). The securities are only available to, and any invitation, offer or agreement to subscribe, purchase or otherwise acquire such securities will be engaged in only with, relevant persons. Any person who is not a relevant person should not act or rely on this document or any of its contents.

In any member state of the European Economic Area, this document is only addressed to “qualified investors” in such member state within the meaning of Regulation (EU) 2017/1129, and no person that is not a qualified investor may act or rely on this document or any of its contents.