Press release

Thun, 2 July 2020

Decision of the Swiss Takeover Board on the non-existence of the obligation to make an offer with regard to Meyer Burger Technology Ltd

For information on the background of the application, please refer to the decision of the Takeover Board dated 30 June 2020 (http://www.takeover.ch). According to the decision of the Takeover Board, Meyer Burger Technology Ltd is obliged to publish the following information:

The Takeover Board takes the decision:

- With regard to Transaction Option I, it is stated in approval of the application no. 1 that Sentis Capital PCC, Zürcher Kantonalbank, Astaris Capital European Opportunities Master Fund Limited and IBH Beteiligungs- und Handelsgesellschaft m.b.H. as well as all other investors who have entered into or will enter into agreements that are substantially similar to the form of the model contract submitted to the Takeover Board (i.e. the draft PIPE and Backstop Commitment Agreement), subject to circumstances not known to the Takeover Board, are not obliged to submit an offer for all listed equity securities of Meyer Burger Technology Ltd pursuant to art. 135 of the Financial Market Infrastructure Act (FinMIA).

- Meyer Burger Technology Ltd is obliged to provide the Takeover Board with a copy of all contracts concluded with the persons mentioned in dispositive no. 1 above with regard to the capital increase, in particular the PIPE and Backstop Commitment Agreements.

- The application no. 2 is approved.

- In approval of the application no. 3, the publication of the present decision in accordance with Art. 61 para. 2 of the Takeover Ordinance (TOO) will be made in coordination with Meyer Burger Technology Ltd by 2 July 2020 at the latest.

- Meyer Burger Technology Ltd is obliged to publish any potential statement of its Board of Directors, the dispositive of the present decision and the reference to the possibility for qualified shareholders to object to this decision, in accordance with art. 61 para. 3 and 4 TOO.

- The fees charged to Meyer Burger Technology Ltd, Sentis Capital PCC, Zürcher Kantonalbank, Astaris Capital European Opportunities Master Fund Limited and IBH Beteiligungs- und Handelsgesellschaft m.b.H. amount to CHF 30,000 under joint and several liability.

Objection (Art. 58 TOO, SR 954.195.1):

A shareholder who can prove that he holds at least three percent of the voting rights in the target company, whether exercisable or not (qualified shareholder, Art. 56 TOO) and who has not previously participated in the proceedings, may object to the present order. The objection must be submitted to the Takeover Board within five trading days of the publication of the present order. It must contain an application and a summary statement of reasons as well as proof of participation pursuant to art. 56 para. 3 and 4 TOO (art. 58 para. 3 TOO).

Contacts:

Nicole Borel

Head of Corporate Communications

Tel: +41 (0)33 221 28 34

Dynamics Group AG

Andreas Durisch, Senior Partner

Tel +41 43 268 27 47 | Mob +41 79 358 87 32

About Meyer Burger Technology AG

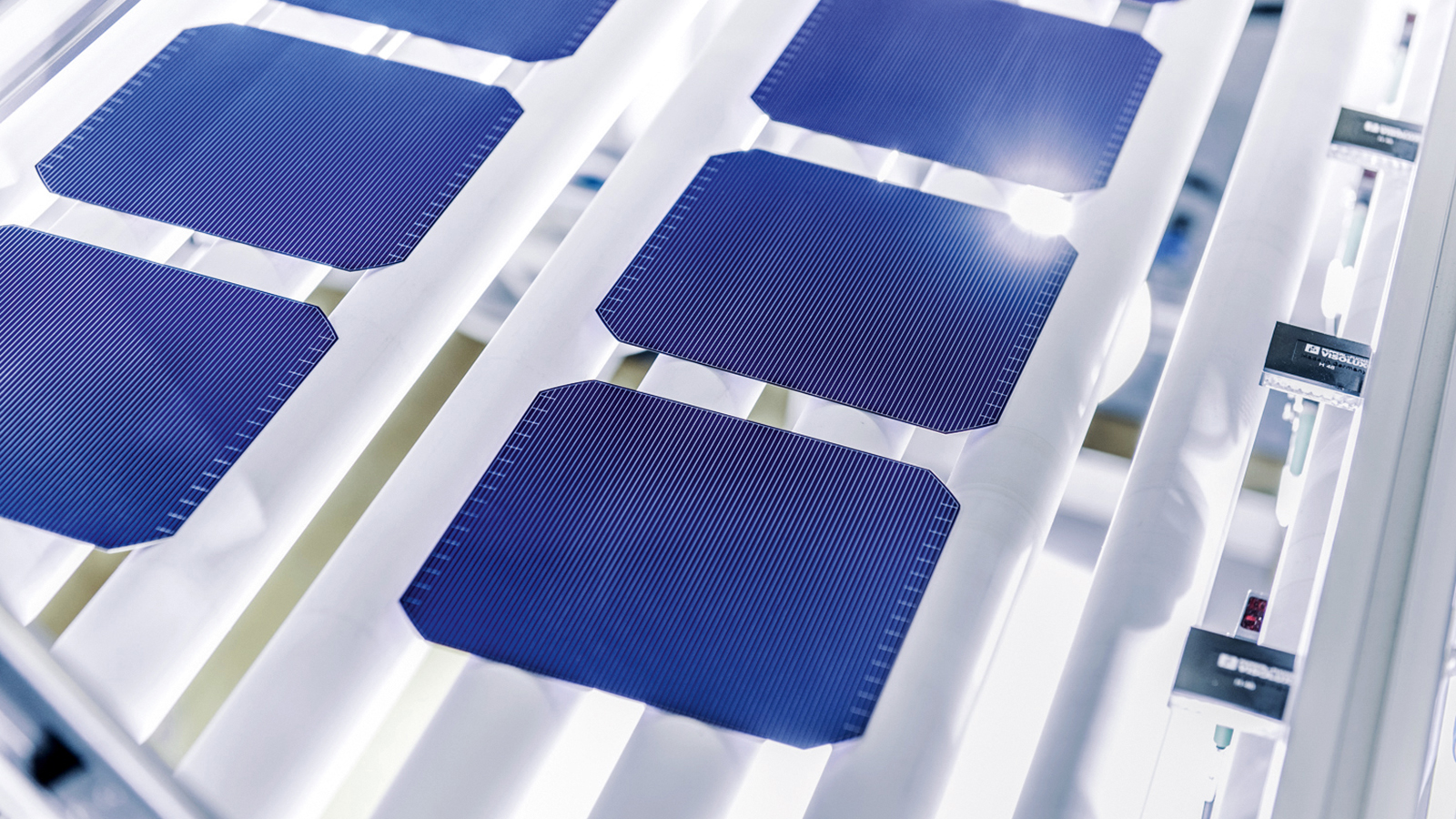

Meyer Burger is a leading technology company with a global presence, specializing in innovative systems and production equipment for the photovoltaic (solar) industry. As an internationally renowned premium brand, Meyer Burger offers its customers in the PV industry dependable precision products and innovative solutions for the manufacture of high-efficiency solar cells and solar modules.

The comprehensive product range is complemented by a worldwide service network with spare and wearing parts, consumables, process know-how, maintenance and after-sales service, training courses and additional services. Meyer Burger is represented in the respective key markets in Europe and Asia and has subsidiaries and its own service centers in China, Germany, Japan, Korea, Malaysia, Switzerland, Singapore, Taiwan and the USA. The registered shares in Meyer Burger Technology Ltd are listed on the SIX Swiss Exchange (ticker: MBTN).

THIS PRESS RELEASE IS NOT BEING ISSUED IN THE UNITED STATES OF AMERICA AND SHOULD NOT BE DISTRIBUTED TO U.S. PERSONS OR PUBLICATIONS WITH A GENERAL CIRCULATION IN THE UNITED STATES. THIS PRESS RELEASE DOES NOT CONSTITUTE AN OFFER OR INVITATION TO SUBSCRIBE FOR, EXCHANGE OR PURCHASE ANY SECURITIES. IN ADDITION, THE SECURITIES OF MEYER BURGER TECHNOLOGY LTD HAVE NOT BEEN AND WILL NOT BE REGISTERED UNDER THE UNITED STATES SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR ANY STATE SECURITIES LAWS AND MAY NOT BE OFFERED, SOLD OR DELIVERED WITHIN THE UNITED STATES OR TO U.S. PERSONS ABSENT REGISTRATION UNDER OR AN APPLICABLE EXEMPTION FROM THE REGISTRATION REQUIREMENTS OF THE UNITED STATES SECURITIES LAWS.

This press release may contain statements referring to the future, such as expectations, plans, intentions or strategies concerning the future. Such statements are subject to risks and uncertainties. The reader is cautioned that actual future results may differ from what is expressed in or implied by the statements. All statements concerning the future in this press release are based on data available to Meyer Burger Technology Ltd at the time of publishing this press release. The company does not undertake to update any future-oriented statements contained in this press release as a result of new information, future events or suchlike.